Felicity Buchan the Conservative housing minister has drafted a letter to her fellow MPs outlining the state of the housing market. In this draft letter she has highlighted that there are 260,000 fewer privately rented households in 2021 than in 2016 according to the English Housing Survey.

This is quite a decline in the number of households, data from Statista showed that the number of renting households during the same period declined 183,000, due to households ‘re-bubbling’ during the Covid crisis. The net affect is 77,000 less rental households available over the last five years.

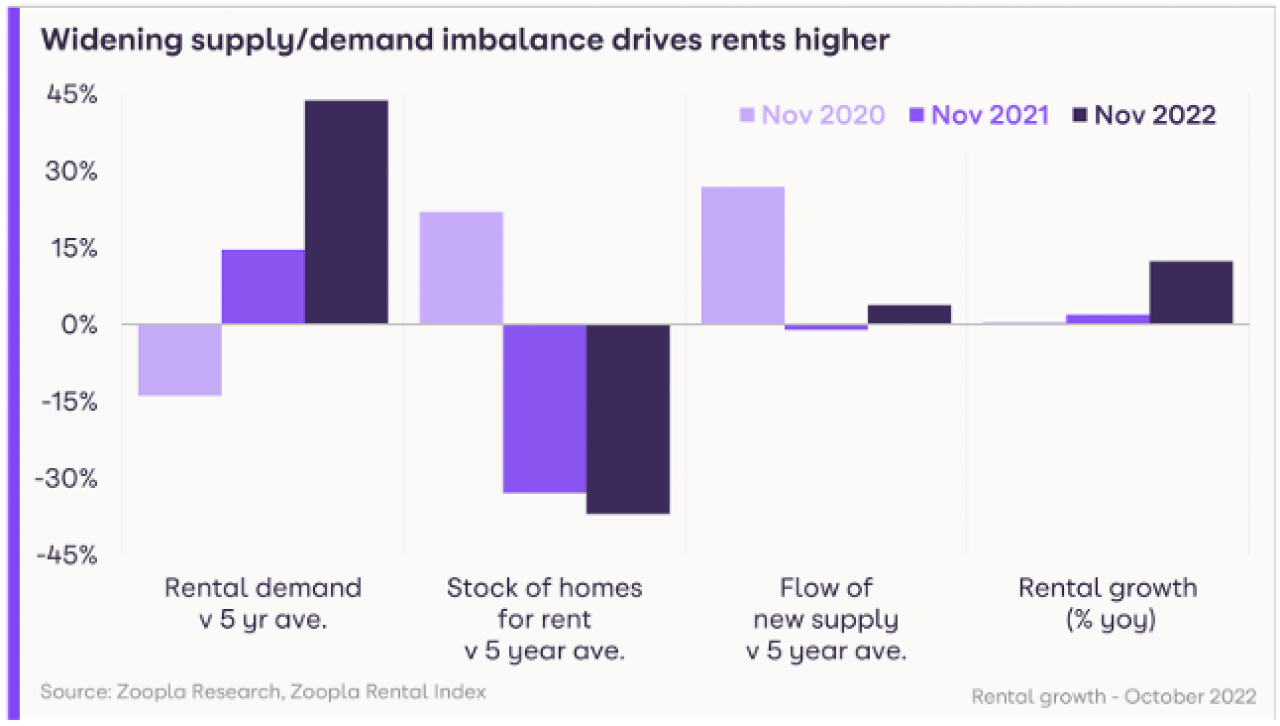

This shrinking supply comes at a time of rising demand, the latest Rental report from Zoopla shows demand almost 40% higher for rental properties in November 2022 versus the year before. The result of this is increasing rent, and worryingly lowering unaffordability.

Rental inflation UK wide stands at 12.1% a trend we are seeing in the local area, this is double the pace of earnings. The result is that rental affordability is at a decade low, accounting for 35% of a single person’s average income. Rents are increasing fastest in larger cities, with London at 17% and Cambridge at 10%. This is creating ever more demand for single bedroom properties, as renters look at way to reduce their expense.

Since the government began restricting finance cost relief for private landlords, the ability to offset mortgage interest payments has been gradually reduced to the basic rate tax reduction over four years, being completed in 2020 to 2021. This has come at a time of rising interest rates, making the burden of such payments on private landlords unsustainable.

Many landlords used the bull market to exit, further reducing the supply in the Private Rental Sector. Refinancing costs have risen dramatically, we have seen landlords being offered 6 to 7 percent rates to refinance, something that given they can no longer offset these against their tax return makes renting privately for many landlords.

The result is a near perfect storm of rising costs, falling supply, and rising demand. Any economics 101 graduate will be able to tell you what the result is, and that will be rising prices. With the current government policy continuing to put burdens on landlords and the interest rate environment making securing new debt inviable this situation is likely to continue in the medium term.

The only mechanism we can see is the destruction of the demand side, if affordability continues to rise at some point people will house share or be forced to alternatives such as social housing. The later would cause even further problems within the market. Another route in which demand may fall is should the economic situation darken further, and unemployment rise this may also remove demand from the market, but again at a horrible social toll.

But as always for well placed individuals these challenges may well result in many opportunities, the combination of negative property price pressures and rising rents can increase the rental returns for liquid landlords, after all a crisis is an opportunity riding a dangerous wind.

Written By Spencer Bullard Managing Director of Abode Town & Country Properties

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link